Table of Content

According to the SBI website, the bank's EBLR is 7.55% +CRP as on 15 June 2022. This is the third time the MCLR rates have been increased.The bank also increased its RLLR and EBLR by 50 basis points to 7.65%. Subsequent to any change in the repo rate of the Reserve Bank of India, SBI's home loan interest rates change on the first day of the calendar quarter.

After all, home loans should be hassle-free, rather than being a time-consuming, way to fulfill your dream. If the borrower has a floating rate home loan then, the change of benchmark repo rate will lead to a change in the interest rate of the loan and the corresponding EMI amount. In practice, a shorter tenure results in higher EMIs, but helps you save on the total interest payout of the loan. Longest loan tenure available across banks and NBFC’s in India for buying a home on a loan is around 30 years, subject to borrower’s current age and retirement age. For SBI balance transfer loans, is the pre-payment penalty also included? Yes, the prepayment penalty will be funded in the SBI balance transfer loans but the total loan amount will be subject to the eligibility as per the relevant SBI home loan scheme.

Customer Service

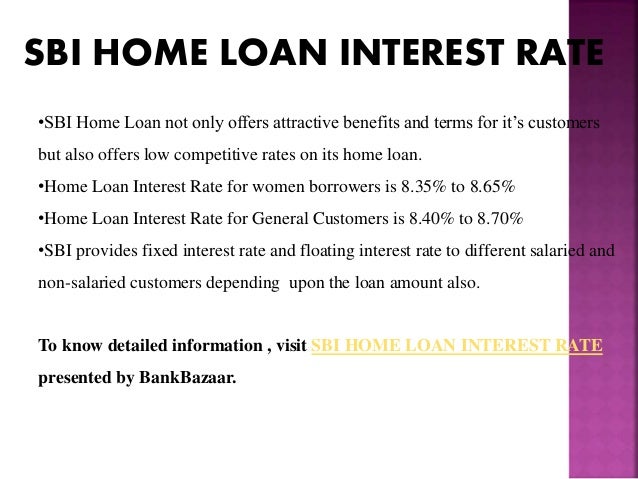

SBI Home Loans start at just 6.90% interest per annum and come with numerous benefits. However, it is important that you check with State Bank of India before you apply for a Home Loan to ensure that your application is not rejected for some reason. Below we’ve noted down a few basic criteria that the bank requires an applicant to fulfil for a Home Loan.

The loan procedure is kept transparent by the SBI Bank without any hidden charges. In case of any confusion, the borrower can contact the loan officer and get more details about all the applicable charges. With floating rates, the interest rate of the home loan will change. If the repo rate increases, then both the interest rate and EMI will increase. Similarly, if the repo rate decreases, then the interest rate and EMI will also decrease.

Amortisation Schedule for a Home Loan of Rs 10,00,000 over 10 Years (120 Months)

To be on the safer side of calculations, use a specific calculator for specific loan types. Calculating the EMI and its components can be a tiring and not-so-efficient task for most first-time financers. A home loan EMI calculator can easily do these complex calculations in seconds, and save you from the trouble of doing it manually.

These are PNB Housing Finance Ltd, Shriram Housing Finance Ltd, IIFL Home Finance Ltd, Capri Global Housing Finance Ltd and Edelweiss Housing Finance Ltd. This was done to provide affordable home loans to all small home buyers in India. SBI home loans have a consolidated processing fee which is 0.40% of the loan amount plus the applicable GST. The minimum amount is Rs.10,000 plus GST while the maximum amount is Rs.30,000 plus GST. SBI interest rates are pegged to floating interest card rate which currently stands lowest at 8.55% p.a. So assuming your tenure to be 30 yrs, below are the details about the interest payable along with the monthly EMI details on your SBI home loan.

Calculate Home Loan EMI

Home loans are connected to external benchmarks, including the RBI repo rate. Get up to Rs.40 lakh with personal loan starting at 10.99% p.a. This table can be used as a reference on how the EMI is calculated.

Just this way, the borrower can apply for a home loan that seems to fit their budget after calculating different EMIs with the SBI Home Loan EMI Calculator. This table shows the various EMI amounts at different loan amounts and tenure at a rate of 6.70 percent. Loan tenure- this tenure is the period within which the borrower needs to pay back the loan amount.

Government Schemes

If the loan amount is high then the EMI amount will also be high, and this can be checked using the online SBI Home Loan EMI Calculator. The minimum loan amount sanctioned by the SBI Home Loan is 25 lakhs, and the maximum amount is 7 crores. Interest rate- the cost for taking a loan is the interest rate paid on it. The higher the interest rate, the higher will be the cost of the loan and the higher the EMI amount. Thus, before taking the SBI Home Loan, make sure to compare various interests so that the borrower can get a loan at a lower EMI.

The age bracket to be eligible for this loan is from 18 to 70 years. The loan amount depends on the financial status of the borrower, their age, the loan tenure, etc. The borrower can use the SBI Home Loan EMI Calculator to further calculate the EMI for any loan amount and tenure. No, SBI Home Loan EMI Calculator is not the same as SBI Home Loan Eligibility Calculator. The SBI Home Loan EMI Calculator tells you about the EMI value. It is dependent upon loan principal, loan term, and the rate of interest.

All one needs is the information of the principal loan amount, rate of interest, and loan tenure. The SBI home loan calculator provides utmost clarity to the potential borrowers on their EMI payments. This enables the borrowers to pre-plan and assess the EMI payment before deciding to take the home loan. You should thoroughly evaluate & compare all your savings through the SBI home loan prepayment calculator. With the house loan calculator find out the EMI then decide the date on which you want to avail of the loan. For loans availed till 15th of a month, EMI is deducted on the 5th of the next month.

Say, the principal amount is Rs.50 lakhs and is taken at an interest rate of 8% per annum. Easy to compare- the SBI Home Loan EMI Calculator is also helpful to compare the EMI of SBI home loans with other bank loans, which have the same tenure and loan amount. The varying interest rate and the calculator will help in finding the cheaper bank loan. As soon as you complete the above steps, your home loan EMI will be displayed along with other details such as total amount payable and also total interest payable.

Step 3 - You need to provide the applicable interest rate of your existing home loan. Please refer to our General Schedule of Features and Charges to know more. I really appreciate Kotak Bank & the team for their efforts in helping me buy my first home. Easy to use- It is a simple and user-friendly home loan EMI calculator anyone can use. The next steps involve making sure one fulfills all the criteria of eligibility and arranging all the necessary documents. You can also negotiate a bit on the rate with the loan provider.

You should choose very wisely between the EMI reduction and loan tenure. By clicking on the hyper-link, you will be leaving and entering website operated by other parties. Kotak Mahindra Bank does not control or endorse such websites, and bears no responsibility for them. By clicking on the hyper-link, you will be leaving and entering our partnered website which will display recurring payment details enabled on your Kotak Bank Credit / Debit Card. Repayment alternatives that are flexible, with terms of up to up to 20 years.

No comments:

Post a Comment